This website is not financial advice. Posts may contain affiliate links from which I earn commissions at no additional cost to you.

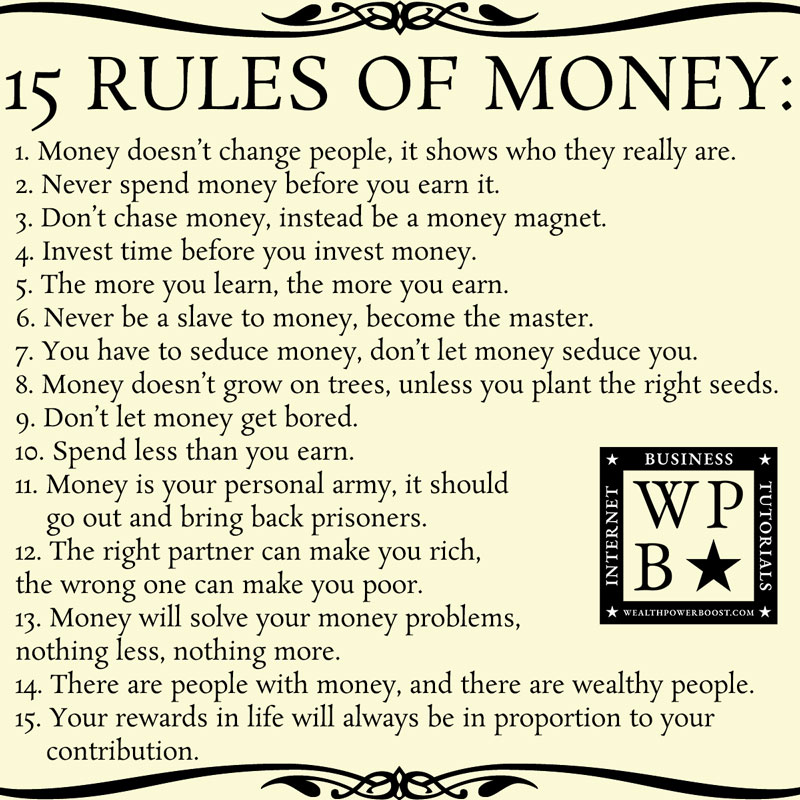

15 Rules Of Money – Graphic © WealthPowerBoost.com

Here’s another excellent inspirational video from Alux. We have listed the 15 RULES of MONEY and added our own summary and notes:

1. Money Doesn’t Change People, It Shows Who They Really Are

The analogy given is that money is like gasoline. It allows you to go further, move faster. But you still need to know how to drive. Money gives people the platform to be who they really are and it magnifies whatever tendencies people have. For example, if you are impulsive, money will not cure you but will allow you to be impulsive on a grand scale – which could lead to bigger problems.

2. Never Spend Money Before You Earn It

In the old days, this was seldom a choice. People could typically only spend what they had already earned and so working first, spending afterwards was the normal way to do things. However now with “buy now pay later” and the various credit instruments, people are being trained to “have it all now”. This is not good for motivation and in addition to this, actually makes you poorer – because of the interest. It alters your perception of what you think you can afford, but credit is not your money and you will have to pay it back.

Related Post: 15 Most Important SKILLS You Need To Develop If You Want To Be RICH

3. Don’t Chase Money, Instead Be A Money Magnet

If you have invested in yourself and become valuable as a person, money is attracted to you. People will want to give you money so that you can help them or give value to them in other ways. This is what it means to be “attractive to money”.

4. Invest Time Before You Invest Money

This means do due diligence and spend time evaluating an opportunity carefully rather than acting impulsively.

5. The More You Learn, The More You Earn

There is an old saying “You must have mindshare before you can have marketshare.” The greater your expertise, the higher fees you can command and the better the products and services you can provide. Seek knowledge and skills first, money second.

6. Never Be A Slave To Money, Become The Master

There is the old saying “The poor work for money, whereas money works for the rich.” The poor working for money – this can be interpreted in two ways; working in order to earn money and literally working for money in the sense that money is the boss and that the poor are working to make the money increase itself (for the rich). Become the Master rather than the slave.

7. You Have To Seduce Money, Don’t Let Money Seduce You

Money escapes from people because they are seduced by the fantasies of what they can have. The correct attitude is to see money as what it actually is: A tool to get things done.

8. Money Doesn’t Grow On Trees, Unless You Plant The Right Seeds

This is a reference to investments. In the same way that an apple tree can yield fruit until you cut it down, money can “bear fruit” so long as you do not “cut it down” i.e. spend the principal. Wealth should be seen as a “money tree” rather than as the fruit. Put your money to work first and then enjoy the fruit but leave the “tree” unharmed.

9. Don’t Let Money Get Bored

This is really about getting the most out of your assets that you can. They should not be left to stagnate. Money should be working hard, not left to gather dust. Bored money also has a tendency to do something impulsive and a pile of cash has an astonishing tendency to melt and disappear as if by magic…

10. Spend Less Than You Earn

Obvious but universally true. As soon as you start spending more than you are earning, you are getting poorer – and at some point, you will end up broke. Usually sooner than you think! The only way to stay rich is to continue to earn more than you spend.

11. Money Is Your Personal Army, It Should Go Out And Bring Back Prisoners

(Metaphorically speaking of course!) What this means is that money should be out there working for you, rather than sitting around doing nothing.

12. The Right Partner Can Make You Rich, The Wrong One Can Make You Poor

Quintessential. Your choice of partner is one of THE most important choices that will dictate not only the quality of your life but the quality of your financial world. First – you are going to spend more time with this person than pretty much anyone else you come across. Choose well! A good rule of thumb is that a good relationship is at least 80% good times. If the bad times creep up beyond 20% of the overall time, something is not right and it probably means this is not working out. You should also choose someone who wants to see you succeed and is a team player, rather than someone who seeks to gain at your expense.

13. Money Will Solve Your Money Problems, Nothing Less, Nothing More

This is an excellent quote. People who have not experienced having money think it will solve all their problems. It will not. The only problems money can solve are problems that were caused directly by its lack. Other problems are not solved and can in some cases be made worse and more complicated by money.

14. There Are People With Money, And There Are Wealthy People

There is a difference between being “cashed up” and wealthy. You can have money and still be in chaos in other aspects of your life. It is possible to have money and yet be so busy, tired, unwell or have other problems that it is impossible to enjoy and feeling of prosperity. True wealth implies that you are in control of not only your finances but your personal affairs, health, relationships and well being are in a state of abundance.

15. Your Rewards In Life Will Always Be In Proportion To Your Contribution

Most people are in it purely for what they can get out of it but this is a strategic error. The wealthy know that if you want more out, you have to put more in.